Generating a tax refund voucher with WestID after the sale

Tax refund vouchers are issued to non-resident customers who are privately exporting purchased goods. In POS Pro, such vouchers can be issued not only at the time of but also after the original sale.

Configuration in CHQ

To use integration with WestID, under CHQ > settings > sales > sales documents, navigate to the tax refund service section and select WestID tax refund in the tax refund service field.

To issue a tax refund voucher after the sale, in POS Pro V6:

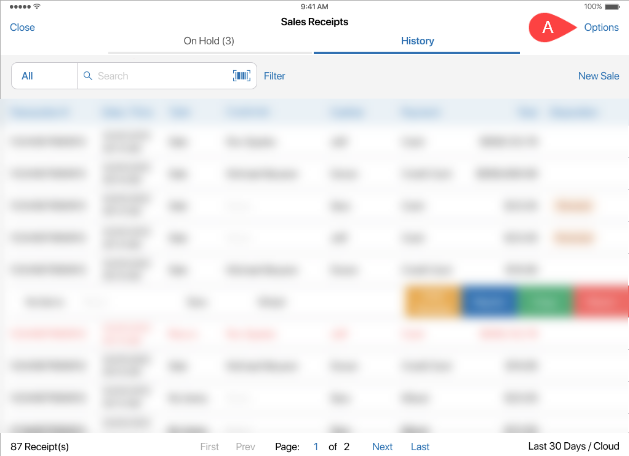

- On the Home Screen, tap Sales Receipts.

Depending on your customs settings, the Sales Receipt button can be located in the navigation panel at the bottom or in the More menu.

-

In the Sales Receipts area, tap the History tab at the top.

-

Tap Options in the upper right corner A and then select Tax Refund Voucher.

-

In the WestID webview that opens, enter the number of the Sales Receipt, required customer information as well as any other information required for tax refunding. The webview will close automatically once the voucher in the PDF format is passed to POS Pro.

Please note that WestID is responsible for the user’s experience as well as processing the user’s actions in the webview. For the best experience, follow your company’s instructions on using WestID for generating tax refund vouchers.

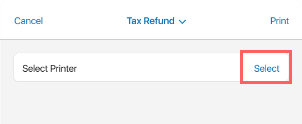

- In the Tax Refund Voucher printing dialog, tap the Select Printer field to select the required printer and then tap Print in the upper right corner.

After printing you will be returned to the Sales Receipt > History area.